us germany tax treaty limitation on benefits

7 a better treaty. 2 a favorable regime for the taxation of intellectual property.

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

WITHHOLDING TAX ON DIVIDENDS.

. This alert concerns one discrete issue that has not yet been decided by the US. The USUK tax treaty includes in Article 23 a limitation of benefits provision that is intended to prevent treaty shopping by residents of third countries attempting to obtain benefits under the treaty. PROVISIONS RELATING TO WITHHOLDING TAX LIMITATIONS ON US.

Shareholders will no longer be considered equivalent beneficiaries for purposes of the. 4 There has been an ongoing. Alia LOB clauses appear in the USGermany tax treaty2 the USSpain tax treaty 3 and very comprehensively in the USNetherlands tax treaty.

To qualify for treaty benefits under the derivative benefits test a specified percentage typically 95 percent of an entitys shares must be owned. Passed by the owners in an attempt to achieve a minimal tax rate or to eliminate tax on the income. 5 no CFC rules.

3 a participation exemption on dividends and capital gains. A where the United States of America imposes tax with respect to property in accordance with Article 5 6 or 8 the Federal Republic of Germany shall credit against the. LOB provisions are intended to prevent so-called treaty shopping arrangements where artificial structures are used to gain access to favourable tax treaties that would not otherwise be available.

Under this clause companies in addition to being a resident of one of the Contracting States must pass different tests to be entitled to most Treaty benefits. Income tax treaty a person must satisfy a number of requirements including residence in one of the treaty countries. The complete texts of the following tax treaty documents are available in Adobe PDF format.

Tests 1 Direct Stock Exchange Test Treaty benefits may be available if inter alia the shares of the corporation. Tax Treaty Limitation on Benefits LOB Form W8-BEN-E. This restricts the availability of benefits such as reduced dividend withholding tax rates provided for by the treaty.

The answer is the ability to gain access to more favorable local tax benefits such as 1 a lower corporate income tax rate. The US-UK competent authority agreement on Brexit confirms that post-Brexit a UK resident is a resident of a Member State of the European Community for purpose of. The first of these tests is that at least 95 of your shares and value is owned by 7 or fewer equivalent beneficiaries.

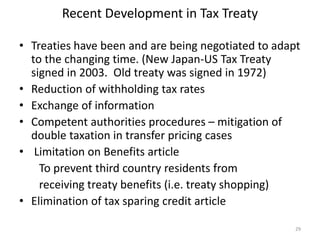

The Limitation on Benefits article is an anti-treaty shopping provision intended to prevent residents of third countries from obtaining benefits under a treaty. Limitation on benefits clauses are drafted with the intention of avoiding treaty shopping whereby a third-party national or corporation sets up a shell company in a contracting state through which income will be passed by the owners in an attempt to achieve a minimal tax rate or to eliminate tax on the income altogether with no expense or real investment. Residents of a country whose income tax treaty with the United States contains a Limitation on Benefits article are eligible for benefits only if they satisfy one of the tests under the Limitation on Benefits article.

Generally a 30 US. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

Common examples of LOB provisions found in Canadas tax treaties are beneficial ownership rules 2 and. For example a foreign corporation may not be entitled to a reduced rate of withholding unless a minimum percentage of its owners are citizens or. Since this first Limitation of Benefit clause which included almost all modern limitations and was considered as a highly innovative clause was introduced in the US- Germany tax treaty.

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Notwithstanding the provisions of Article 28 Limitation on Benefits a German company or organization operated exclusively for religious charitable scientific educational or public purposes shall be exempt from tax by the United States in respect of items of income if and to the extent that a such company or organization is exempt from tax in the Federal Republic of. Withholding tax applies to payments of US.

The United States is very concerned about treaty shopping. Limitation on benefits clauses are drafted with the intention of avoiding treaty shopping whereby a third-. Where the Federal Republic of Germany imposes tax by reason of the domicile therein of the decedent donor heir donee or other beneficiary double taxation shall be avoided in the following manner.

In order to enjoy the benefits of a US. If that is the case the US-German tax treaty as modified by the new Protocol the Treaty generally will be effective for withholding tax on payments made after December 31 2006 and for income taxes for taxable years beginning after December 31 2006. Under this clause there were three alternative methods through which an individual or entity could qualify for tax benefits.

Germany - Tax Treaty Documents. The treaty has been updated and revised with the most recent version being 2006. Party national or corporation sets up a shell company in a contracting state through which income will be.

If the foreign person qualifies for benefits under an income tax treaty with the US the withholding tax rate may be reduced. Sourced income made to foreign persons. In order to prevent tax avoidance and tax evasion states came up with different approaches.

4 no outbound withholding tax on interest dividends or royalties. Northwestern Pritzker School of Law. Residence alone however is not sufficient.

Treaty provides for a limitations on benefits clause. Limitations on benefits provisions generally prohibit third country residents from obtaining treaty benefits. These provisions commonly referred to as limitation on benefits LOB provisions 1 generally seek to deny the benefits of the tax treaty or the benefits of a particular provision in the tax treaty where the conditions of that rule are met.

In order to qualify for benefits under an income tax. Treasury but that could have dramatic consequences for entities currently claiming the benefit of US. These are residents of a country within the EU or NAFTA that qualify under a different treaty with the UK or US and.

The United States is a party to numerous income tax treaties with foreign countries. Germany and the United States have been engaged in treaty relations for many years. US and German employees will also be exempt from paying the personal income tax if they are in the other country for 183 days maximum during a calendar year and if the income is paid by a non-resident company.

US sole traders will benefit from the same treatment in Germany. 3 While Germany in its treaty policy seeks to avoid the abusive use of DTT by referring to national anti abuse rules 4 the USA always insisted on the conclusion of an anti abuse rule in the DTT the so-called Limitation of Benefits Clause LOB. 6 no thin capitalization rules.

Whether the United Kingdoms withdrawal from the European Union means that UK.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Effect Of Tax Benefits On M A Being Withdrawn Ipleaders

German Law Removes Us S Corporation Tax Benefit

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

Taxation Changes In Indonesia Under Tax Regulation Harmonization Law

Tax Incentives For Investment In Developing Countries In Imf Staff Papers Volume 1967 Issue 002 1967

United States Germany Income Tax Treaty Sf Tax Counsel

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

German Law Removes Us S Corporation Tax Benefit

Tax Advantages For Donor Advised Funds Nptrust

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Corporate Tax Report 2022 Germany

Hungary Taxing Wages 2021 Oecd Ilibrary

Sme Capital Gains Tax Who Actually Gains By Amarit Aim Charoenphan The Aim Is The Way Medium