nj bait tax instructions

499 Seventh Avenue1200 Tices Lane 6th Floor South New York NY 10018 Tel. New Jersey Business Alternative Income Tax NJ BAIT Knowledge Hub.

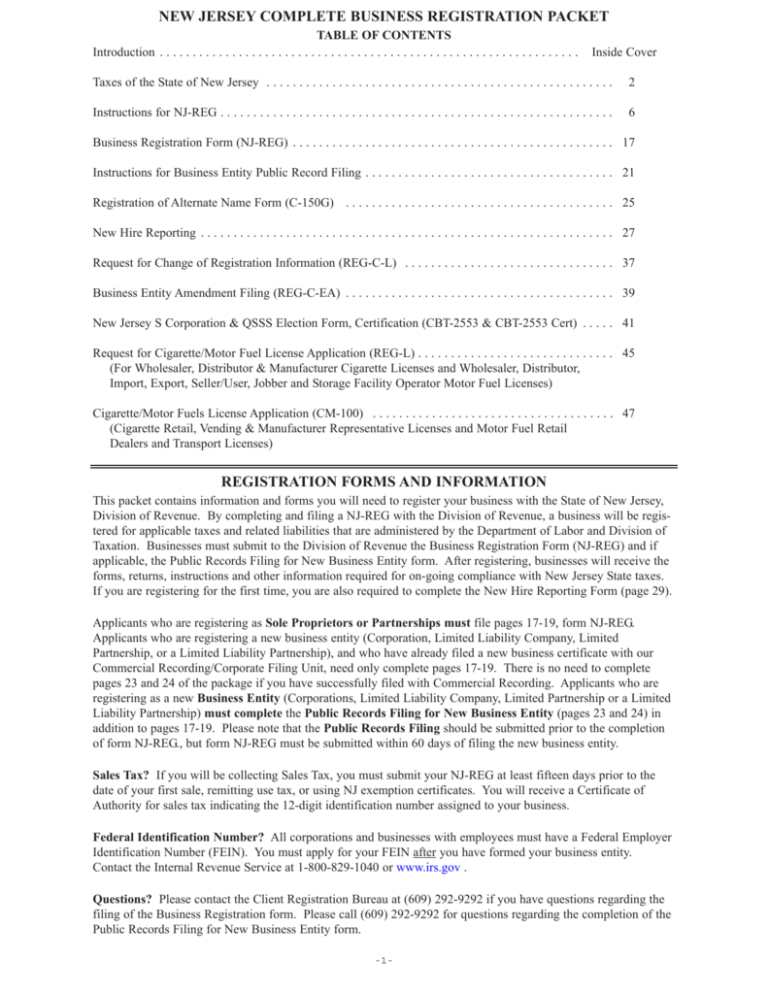

New Jersey Complete Business Registration Package

Pass-through entities must pay estimated tax electron- ically by e-check electronic funds transfer EFT or credit card.

. This way it reduces the federal taxable income on your personal return which is what the. 2021 Pass-Through Business Alternative Income Tax Return Instructions. Single member limited liability companies and sole proprietorships may not elect to pay the Pass-Through Business Alternative Income Tax.

Starting with the 2021 reporting year the BAIT computation begins with New Jersey taxable income and results in better alignment with the owners New Jersey tax liability. 54A1-1 et seq in a taxable year. The Gross Income Tax Act GIT at NJSA.

An entity must first register with the New Jersey Division of Revenue and Enterprise Services to take advantage of the BAIT. Trenton NJ 08695-0187 Corporation Business Tax Pass-Through Business Alternative Income Tax Only for tax-exempt corporate members other than IRC 501c3 entities and retire-ment. NJ Division of Taxation - Partnerships.

COVID-19 is still active. PTE-200-T extension requests along with payment must be filed online at njgovtaxation until 1159 pm. Taxpayers must enter their New Jersey taxpayer identification number and either their 4-digit Personal Identification Number PIN or the first four characters of their registered.

Go to the Division of Taxations website at. 419 revises the New Jersey elective pass-through entity business alternative income tax which was enacted in January 2020. On January 13 2020 Governor Phil Murphy signed into law Senate Bill 3246 S.

Instructions for Completing the. Tax is imposed on the sum of each members share of distributive proceeds which is 1500000. ALTERNATIVE TO CAST NET FOR CATCHING LIVE BAIT.

Income in excess of 1 million is taxed at 109. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business. Using the table above tax is calculated on the 1500000 as follows.

To participate the entity must file an election form annually. Pass-Through Business Alternative Income Tax Return Instructions. Assume a PTE filed its 2021 BAIT return on.

On or before the original due date of the return March 15 for calendar year filers. 388000 50 of 800K less 24K of NJ BAIT deducted at entity level Federal Income Tax. Estimated Income Tax Payment Voucher for 2022.

The entity must have at least one member who is liable for tax on their share of distributive proceeds pursuant to the New Jersey Gross Income Tax Act NJSA. 140000 400K x 35 135800 388K x 40 NJ Income Tax. Application for Extension of Time to File Income Tax Return.

54A8-6 requires entities classified as a partnership for federal income tax purposes having a resident owner or income. 3246 or bill establishing the business alternative income tax BAIT an elective New Jersey. MarriedCU partner filing separate return.

The New Jersey pass-through entity tax took effect Jan. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. Fishing a crowded pier in the Atlantic City NJ area.

New Jersey Gross Income Tax Fiduciary Return Form NJ-1041 if gross income before exemptions or deduc-tions was more than 10000 prorated for the number of months. Changes are effective for tax years beginning on and after January 1 2022. MarriedCU couple filing joint return Head of household Qualifying window ersurviving CU partner.

Enter it as a business expense under taxes states taxes paid. Stay up to date on vaccine information. Estimated Income Tax Payment Instructions.

This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level. Fishing and Cast Netting Mullet LBI NJ 916-2515.

New Jersey Pass Through Business Alternative Income Tax Bait Updates Marcum Llp Accountants And Advisors

Nj Bait Deduction On Form 1040

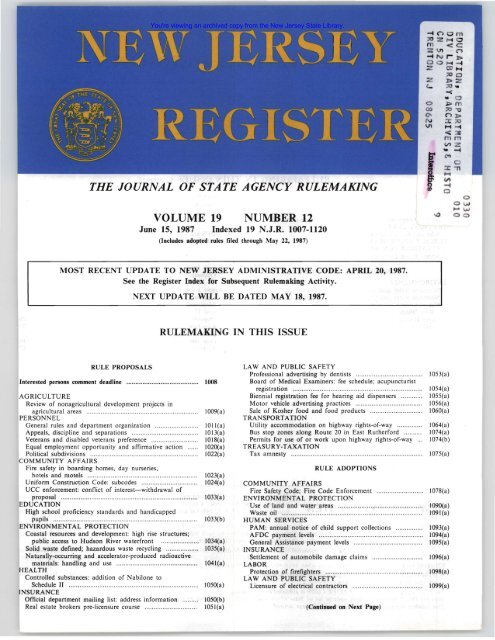

Number 12 Pages 1007 1120 Law Library The New Jersey State

The New Jersey Business Alternative Income Tax Nj Bait What You Need To Know Rosenberg Chesnov

New Jersey Business Alternative Income Tax Nj Bait Tax Knowledge Hub

.png?Status=Master&sfvrsn=88ed713a_0)

New Jersey Business Alternative Income Tax Nj Bait Tax Knowledge Hub

New York Ptet Nj Bait Amp Connecticut Ptet An All New Detailed Exp Ace Seminars

New Jersey Business Alternative Income Tax Nj Bait Tax Knowledge Hub

New Jersey Pass Through Business Alternative Income Tax New Jersey Mercadien

Where S My Refund New Jersey H R Block

Number 17 Pages 2971 3202 Law Library The New Jersey State

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

Nj Bait Deduction On Form 1040

New Jersey Business Alternative Income Tax Nj Bait Tax Knowledge Hub

New Jersey Pass Through Business Alternative Income Tax Act Bait L H Frishkoff Company